“I decided last night that I would double down.”

This was the first line of an email I sent on November 10, 2016 to remind friends of an upcoming breakfast I was co-hosting with one of my favorite non-profits to advance girls’ health, education and equity. The email continued:

“I will continue to do my part. I will seek to lead by example. I’ve chosen girls’ education and empowerment as a focus in seeking to bridge division and inequality. It’s only become more important. I’m not moving to Canada. Instead, I’m going to double down in my efforts.”

I didn’t really know what I meant by doubling down. That didn’t matter.

What mattered was that I made a decision to deepen my efforts, and that I announced it publicly. When others hear me speak out loud, I’m accountable.

It’s a little trick I play on myself. When I boldly speak a goal, I later achieve it. I figure out the details later.

In The Smart Investment, I shared my decision to transition my U.S. large cap equity investment portfolio to a gender lens strategy. It puts my money where my mouth is. My investments would align with the leadership I’d like to see in corporate America. The risk and return profile of my portfolio would remain similar to the S&P 500, but I’d get there by only holding “gender-smart” companies.

But transitions don’t always go smoothly.

With strong U.S. equity market returns over the last several years, my portfolio was sitting on some sizable gains. I had a host of existing holdings that didn’t currently qualify as “gender smart”–Exxon, Verizon, Costco and Bank America. They would need to be sold in the transition, resulting in a sizable capital gains tax bill.

Argh, taxes!

I was stuck. This was something I really wanted to do. But at what cost?

I put my transition project on hold. Perhaps I’d figure out other options. Perhaps the market would dip.

At the same time, I kept thinking about my pledge to double down in the support of girls’ education and empowerment. Was I putting my time, talent and treasure to the greatest use? Was I being bold enough in my investing and giving?

I was feeling the need to be louder and bolder; to be even more strategic and focused. I wanted to create something. I wanted to be pushing my later-in-life legacy forward.

I wanted a big challenge; to feel pushed outside of my comfort zone.

I decided to make a big, bold contribution to my donor advised fund.

Donor advised funds are one of my favorite tools–the perfect bridge between your money (investments) and the change you wish to see in the world (non-profit organizations).

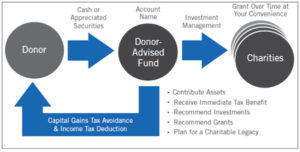

The donor advised fund (DAF) is an intermediary. Because the DAF itself is a charitable organization, I can donate assets to the DAF. The best assets to donate are highly appreciated ones–public or private stock, land, even art. For example, if I give $1000 in stock that I originally purchased for $100, I’m able to deduct $1000 as a charitable contribution on my tax return. Given its charitable status, the DAF can turn around and sell the stock for cash with no need to recognize or pay the capital gains tax that an individual would otherwise pay.

I can then choose how to invest the full $1000 in my account across the DAF’s host of investment options. Like a retirement account, the money will grow tax free. When I wish to make a donation–to support my friend’s summer bike ride for cancer, Hurricane Harvey relief efforts, or my strategic non-profit partners in girls education and empowerment–I direct my DAF to distribute the funds.

It’s like my own little private foundation. I have an account titled in my name, and I contribute to it whenever and however I choose. I grant gifts whenever and to whomever I choose. Anyone can set up a DAF through most major brokerage platforms; Fidelity, Charles Schwab and Vanguard are among the largest donor advised funds (and charitable organizations) in the U.S.

But back to my big, bold challenge. How is making a transfer of assets to my donor advised fund something that pushes me out of my comfort zone?

It does in a few ways.

- First, for me, the size of this particular irrevocable gift was a big deal. My current assets and my future earnings are all I’ve got. There’s no expected windfall in my future. Given this, I’ve always been conservative in my spending and prudent in my financial decisions.

- Second, talking about my personal money decisions publicly feels awkward. Yet one of my wishes is for people to be purposeful and open about their values and goals, and to align their money with those goals. So yes, it feels uncomfortable. But I need to exemplify the change I wish to see.

- Finally, making this contribution to my DAF isn’t itself the challenge; it’s just a first step towards my commitment to double down.

I wanted to transition my investment portfolio to a gender lens strategy. But the prospect of a huge tax bill stopped me in my tracks.

Now I had the perfect solution: I transfer the non-gender qualifying appreciated stock holdings out of my portfolio and into my donor advised fund. There are no capital gain tax consequences; instead I take a sizable charitable deduction. I celebrate the capital gains from the rising stock market of the last several years, which allow me to make this outsized charitable gift. My DAF sells the stock holdings, and I choose how to invest the cash so it continues to grow.

Over future years, I’ll continue to make strategic investments in girls’ education and empowerment through my favorite non-profits. In my commitment to double down, I launched Venture Travels, combining a multi-year financial commitment and my passions for global experiences, community and personal growth.

What can you do? Double down with me! Use your greatest tools towards leading the change you wish to see.

-

- Your money is a tool. Invest it in a way that aligns with your values.

-

- Know what you stand for. Align with one or a handful of organizations who lead the change you wish to see.

-

- Have a donor-advised fund. Use it as a bridge between your assets and non-profit partners.

So push forward your future charitable giving. The time is now. You never know when new tax plans might put limits on charitable deductions in our immediate future

Click for more Impact Investing Insights.

Photo Credit: Tunica Travel